Residential Lazy River Cost & Design Guide

Imagine floating effortlessly through your own backyard oasis on a warm afternoon.

3 min read

Daniela Escudero

:

October 23, 2025

The Hidden Dangers of Pool Construction: What Homeowners Need to Know

What happens if a crane tips over, a trench collapses, or heavy equipment damages your neighbor’s property during pool construction?

And more importantly, are you financially responsible if your contractor isn’t insured?

In this article, you’ll learn exactly which safety standards and insurance coverages protect you from hidden pool construction risks.

You’ll see the seven most common dangers on a pool site, what every insurance policy should include, why licensed contractors cost more, and how to verify coverage before you sign.

Many homeowners assume that pool construction is a simple process. The truth? It’s one of the most deceptively dangerous trades in residential building.

Heavy equipment, deep excavations, high-voltage systems, and exposed rebar all carry serious injury and liability risks.

Even one safety lapse can lead to thousands of dollars in damages or legal exposure, for both the contractor and the homeowner.

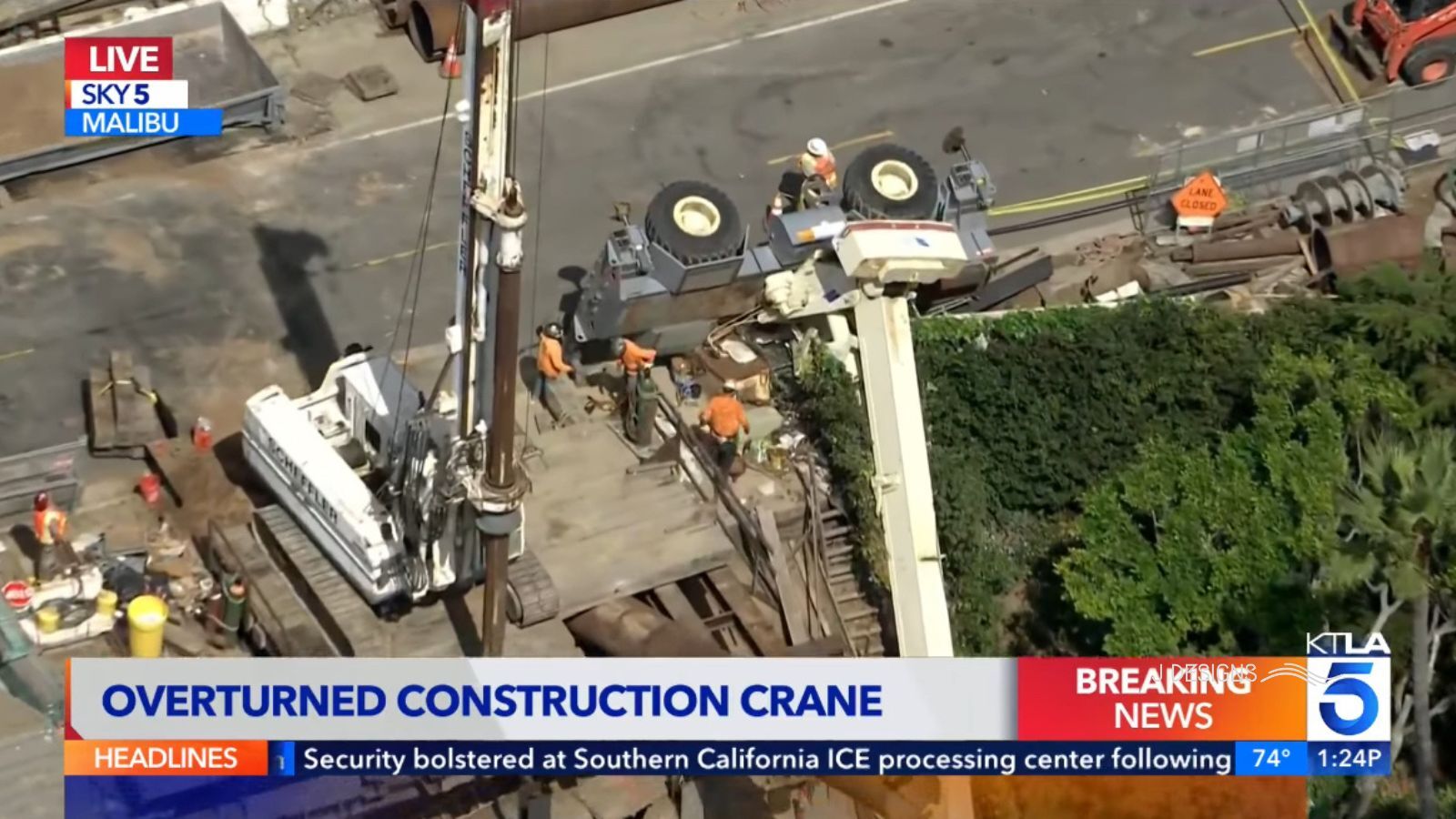

A recent crane mishap in Malibu shut down a pool site for over six months.

One machine error can halt progress, cause injuries, and trigger costly investigations.

OSHA lists trench collapses as one of the deadliest construction accidents.

Without proper shoring, a trench can cave in and bury workers within seconds, leaving you potentially liable.

Faulty wiring, pump installation errors, and poor grounding can cause shocks, fires, or electrocution.

Electrical work should only be handled by licensed professionals.

Everyday tools like saws and drills can cause serious injuries in seconds.

A single moment of distraction can result in long-term injury or even amputation.

Working at elevation during construction or finishing requires the use of proper guardrails and harnesses.

Falls remain a top cause of fatal construction injuries.

Uncapped steel rods are often overlooked hazards.

If a worker falls onto exposed rebar, injuries can be catastrophic, or fatal.

Skid loaders, bobcats, and cranes operate within your property boundaries, not on public roads.

If one damages your fence, neighbor’s wall, or structure, you need proper insurance coverage in place.

Why Contractor Insurance Protects You, Not Just the Crew

When accidents happen, insurance determines who pays the price, you or your contractor.

Pro Tip: Skid loaders and bobcats rarely leave the property, so standard auto policies don’t cover them.

Make sure your contractor has property damage coverage for equipment operating on-site.

Also, check whether subsidence (soil movement) or “pool pop-up” risks are excluded; these are common blind spots in cheap policies.

Homeowners often ask:

“Why does a licensed, insured pool company cost more than a cheaper contractor?”

The answer: Professional protection has real costs, and real value.

Here’s what most reputable contractors pay annually:

|

Coverage Type |

Typical Cost Range |

|

General Liability |

$5,000–$15,000 / year |

|

Workers’ Compensation |

~$7–10 per $100 of payroll |

|

Commercial Vehicle |

$1,500–$3,000 per vehicle |

|

Builder’s Risk Insurance |

1–3% of the total project cost |

|

Surety Bonds & Licensing |

$500–$5,000 annually |

Those costs aren’t markup, they’re peace of mind.

That extra 10–20% you pay for a licensed builder provides the financial safety net that no homeowner ever wants to need, but will be grateful to have when something goes wrong.

Think of it this way: The more insured your contractor is, the safer your investment becomes.

If your contractor skips coverage to cut costs, you risk:

A cheaper bid today could cost you tens of thousands tomorrow.

Use this quick checklist when interviewing contractors:

Verify their license

Check your state’s licensing board for current, active, and relevant credentials.

Request proof of insurance

Ensure certificates show liability, workers’ comp, vehicle, property, and builder’s risk coverage.

Ask about safety protocols.

If a contractor can’t explain how they handle trenching, scaffolding, PPE, or rebar, walk away.

Ask about exclusions

Ask directly: “Is subsidence or pool pop-up excluded?” and “Who covers adjacent property damage?”

Put everything in writing.

Document safety responsibilities and insurance requirements in your contract.

Check subcontractors

Ensure all subs carry valid insurance and are listed as “additional insureds.”

After your pool is completed:

You now understand the biggest construction hazards, the importance of full insurance coverage, and why licensed pool builders cost more, but protect you more.

You came here to avoid financial surprises, safety risks, and legal exposure, not just to learn construction tips.

Before hiring, ask for proof of every insurance policy and bond. Verify that vehicle, property, and worker coverage are all up to date.

Since 2008, at J Designs has made safety and compliance non-negotiable. Every project we build is fully insured, code-compliant, and backed by the coverage your investment deserves. Check out our Pool Builder Credentials article.

Imagine floating effortlessly through your own backyard oasis on a warm afternoon.

If you’re planning to build or remodel a pool in 2026, you’re not just choosing a “look”; you’re making a long-term investment in your home, your...

Pool Overflows After Heavy Rain and How to Lower Your Pool's Water Level